A focused look at why debt collection teams need a smarter debt follow-up system to improve visibili...

Learn how to implement a smarter debt followup system in Egypt step by step, boosting efficiency, re...

This blog explains the key debt collection challenges faced by agencies in Kenya and how a smart, au...

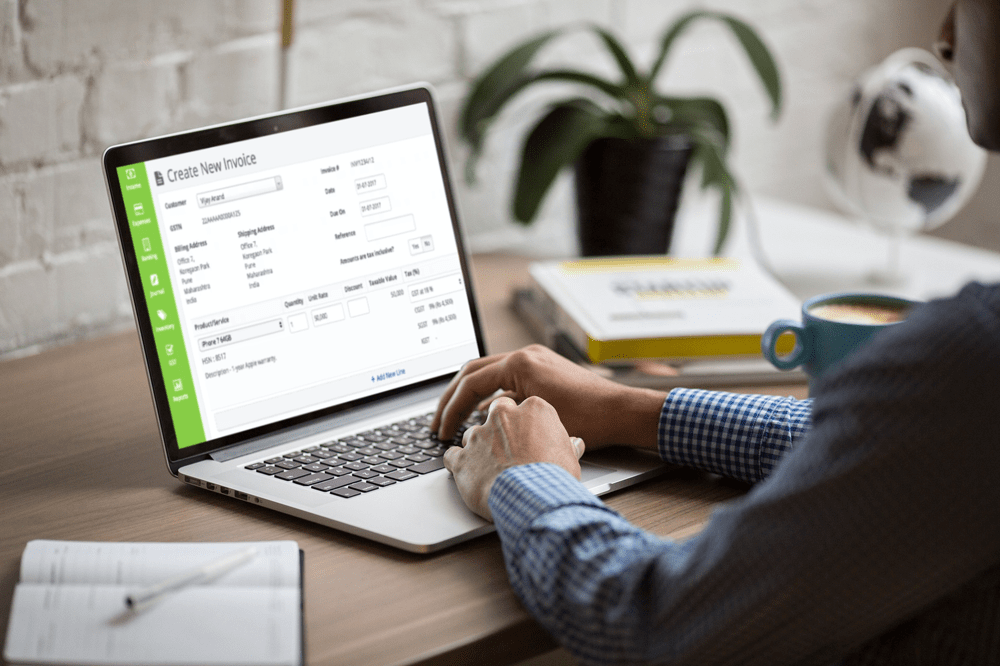

In today's fast-paced business environment, managing payment disputes effectively is crucial for maintaining strong client relationships and ensuring a healthy cash flow. However, handling these disputes also comes with the responsibility of ensuring legal compliance. A Payment Dispute Management System (PDMS) can be a valuable tool in achieving both efficiency and adherence to legal standards.

Payment disputes can arise from various issues, such as billing errors, contractual misunderstandings, or service dissatisfaction. When these disputes occur, businesses must navigate a complex legal landscape to resolve them properly. Failing to comply with legal regulations can result in penalties, damage to reputation, and strained customer relationships.

A well-implemented PDMS streamlines the dispute resolution process while ensuring that all legal requirements are met. Here are a few ways it aids in maintaining compliance:

A PDMS automatically records all communications, transactions, and dispute resolutions. This thorough documentation can serve as crucial evidence if a dispute escalates to legal proceedings.

These systems can send automated reminders to clients regarding upcoming payment deadlines or dispute resolutions, reducing the chances of miscommunication and misunderstandings that could lead to legal issues.

Many PDMS platforms include features that monitor compliance with relevant laws and regulations, alerting businesses to any potential violations before they become serious problems.

By providing comprehensive reports on dispute trends and resolutions, a PDMS helps businesses identify areas of concern and adjust their practices accordingly to stay compliant.

For businesses in Saudi Arabia looking to enhance their payment dispute management while ensuring legal compliance, Smart Debt Collection stands out as the best payment dispute management system. Its user-friendly interface, robust automation features, and strong compliance tracking capabilities make it an ideal solution for companies aiming to resolve disputes efficiently and within legal frameworks.

utilizing a Payment Dispute Management System like Smart Debt Collection not only streamlines the dispute resolution process but also plays a vital role in ensuring legal compliance. By adopting such systems, businesses can protect themselves from legal repercussions while maintaining positive relationships with their clients.

Best payment dispute management software solutions in SaudiArabia

Best payment dispute management system in SaudiArabia

Best payment dispute management platforms in Saudi Arabia

If you need free demo on best payment dispute management software solutions in SaudiArabia, please fill the form below